Latest Insights on Bitcoin Dominance: Current BTC Market Share and Future Trends

What Is Bitcoin Dominance

Bitcoin Dominance measures the percentage of Bitcoin’s (BTC) market capitalization relative to the total market capitalization of all cryptocurrencies. In essence, it reflects Bitcoin’s influence and standing within the broader crypto market. The ratio is calculated by dividing Bitcoin’s current market capitalization based on circulating supply by the global cryptocurrency market capitalization.

This metric helps investors analyze capital flows. When Bitcoin Dominance rises, it signals a shift of funds toward Bitcoin as a safe haven asset. Conversely, a decrease in dominance may indicate that investors are pursuing higher-risk, higher-reward altcoins.

Latest Bitcoin Dominance Data and Market Overview

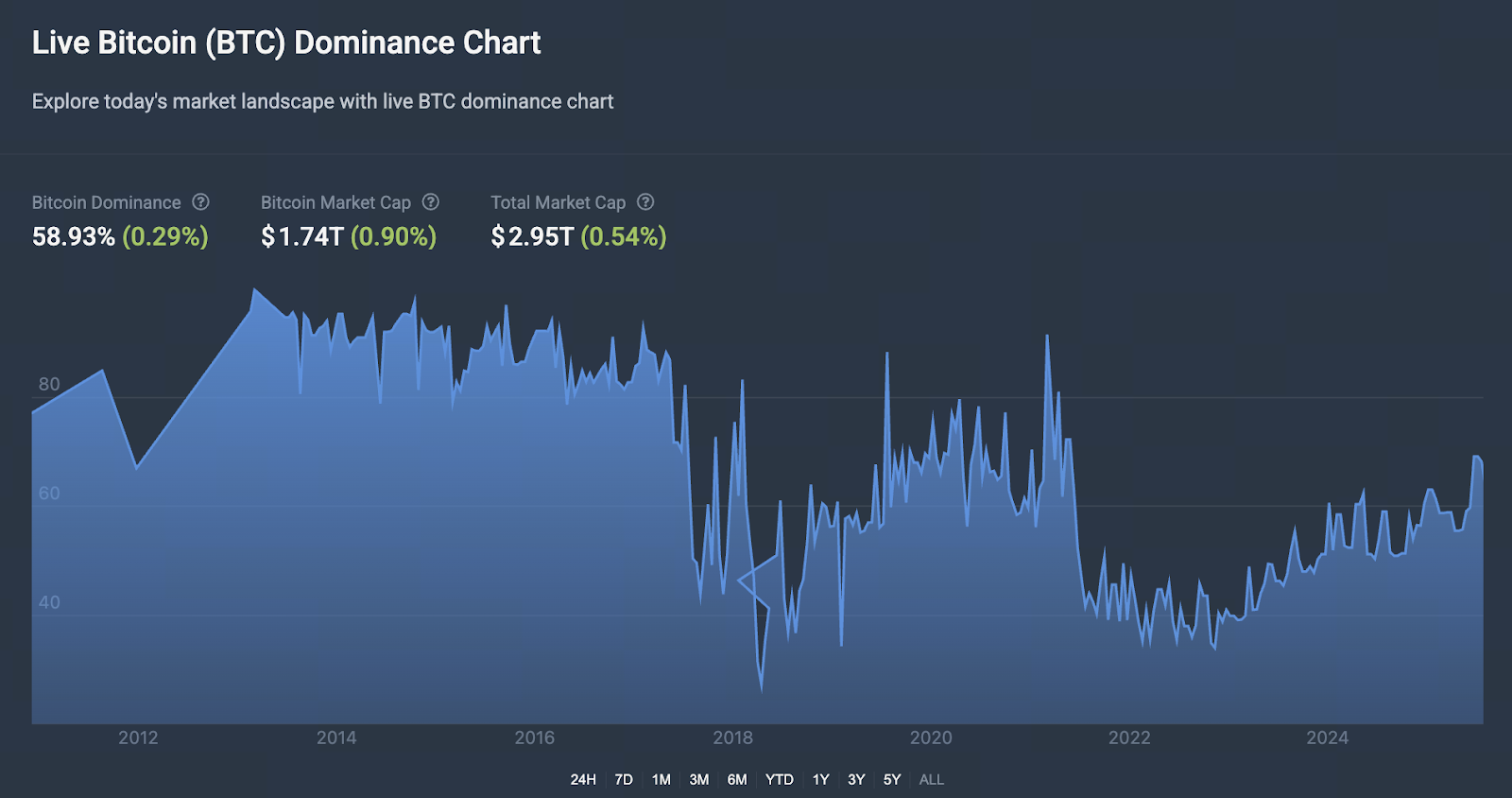

Chart: https://coincodex.com/bitcoin-dominance/

According to the latest figures, Bitcoin Dominance currently stands at approximately 58.94%.

Other sources note that Bitcoin Dominance recently dipped below the 60% threshold.

Overall, Bitcoin Dominance remains close to 60%, reinforcing Bitcoin’s position as the leading force in the cryptocurrency market.

Why Is Bitcoin Dominance Significant? What Does It Signal?

- Market Sentiment and Capital Allocation: Elevated Bitcoin Dominance typically points to a more conservative market stance—investors favor Bitcoin over riskier altcoins. Lower or declining dominance can suggest capital is shifting toward altcoins.

- Identifying altseason: Many market participants regard Bitcoin Dominance as a key indicator for potential altcoin rallies. Generally, sustained declines in Bitcoin Dominance, coupled with capital flows into altcoins, can trigger altseason.

- Risk and Opportunity: High Bitcoin Dominance means market capital is concentrated, enhancing overall resilience to risk. However, excessive dominance may indicate a lack of enthusiasm for altcoins, possibly suppressing upside opportunities.

What Do Current Trends Indicate: Altcoin Opportunities or Continued Bitcoin Strength?

While Bitcoin Dominance remains elevated at approximately 58.9%, recent analysis suggests its long-term ascending wedge pattern has been breached, potentially signaling a shift in market structure.

- If Bitcoin Dominance continues to decline, capital may gradually move into altcoins—an attractive scenario for investors seeking higher risk and returns.

- Conversely, if Bitcoin Dominance climbs back above key resistance levels—such as 60%—and holds, Bitcoin may continue to lead the market. A broad altcoin rally would be less likely in this scenario.

In summary, the market is at a pivotal juncture: Bitcoin remains dominant, but altcoin potential is restrained. If dominance drops and sentiment shifts, altcoins could be poised for a rebound.

Investor Recommendations

- Monitor Bitcoin Dominance closely—use it as a key market indicator, not just the price of Bitcoin.

- Diversify your portfolio—if you seek risk and reward, consider allocating to altcoins, but don’t overlook Bitcoin’s stability and risk mitigation.

- Establish clear expectations and risk controls—altcoins are typically more volatile than Bitcoin, with sharper price swings.

- Maintain patience and a long-term perspective—regardless of Bitcoin Dominance fluctuations, the crypto market’s long-term potential remains compelling.

In conclusion, Bitcoin Dominance live is more than just a data point—it’s a vital gauge of market sentiment, capital flows, and future trends in the crypto space. With Bitcoin Dominance currently around 58.9%, Bitcoin remains the market leader. By keeping a close watch on this ratio, you may be able to seize the next wave of altcoin opportunities as market conditions evolve.

Related Articles

The New Era of the NFT Market: From Explosive Peaks to Rational Transformation

The Next 100x Coin? Low-Cap Crypto Gem Analysis

MathWallet Quick Start Guide

Zora NFT Market Update: ZORA Token Airdrop, Layer-2 Expansion, and Creator Incentive Mechanisms

Ethereum Whales Revealed: Who Are the True ETH Giants in 2025?