Latest Meebits Floor Price Trends: NFT Market Sentiment and Potential Investment Opportunities

What Are Meebits?

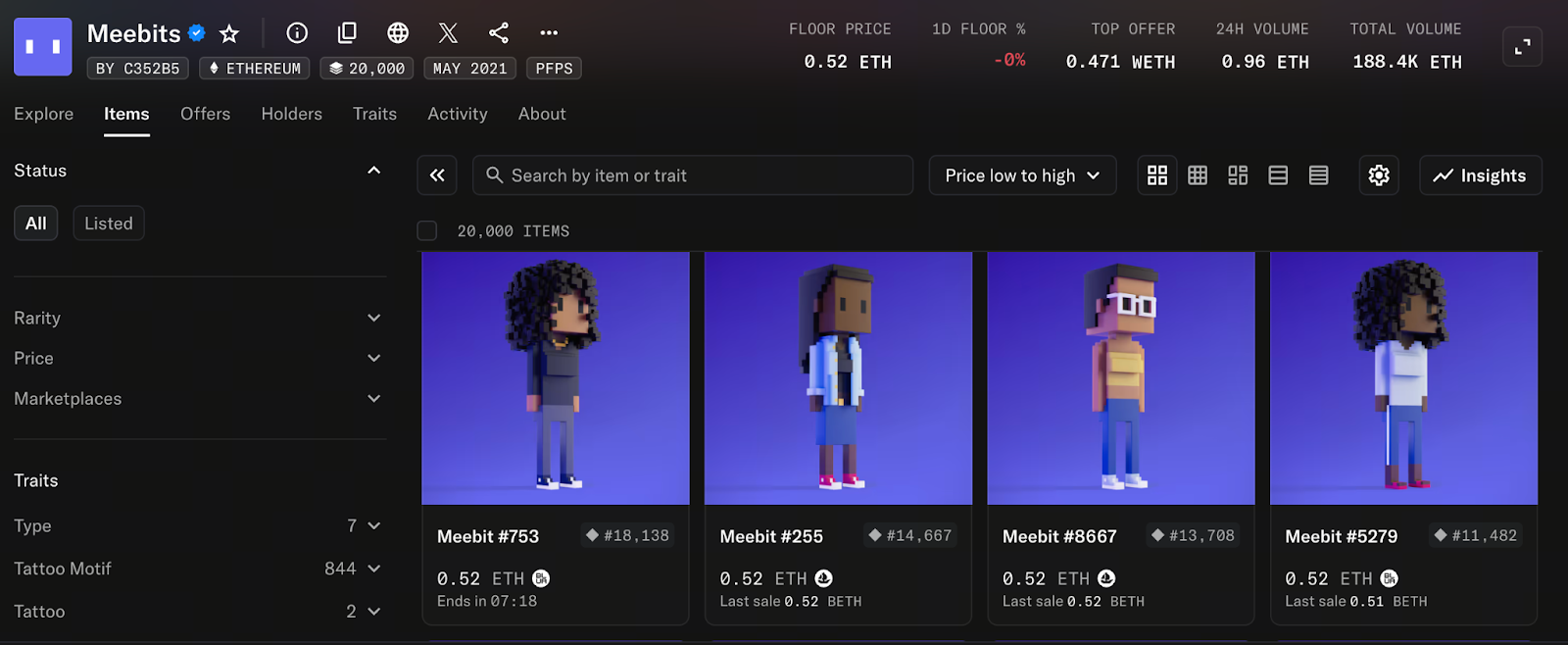

Larva Labs created Meebits, a collection of 3D voxel character NFTs. The series consists of 20,000 avatars with traits generated with a high degree of randomness. These are suitable for use as social profile images, with potential for integration into metaverse platforms. Yuga Labs currently owns the intellectual property for Meebits, which connects Meebits with other prominent NFT collections, such as BAYC (Bored Ape Yacht Club).

Latest Performance of the Meebits Floor Price

As of November 17, 2025, per Opensea data, the Meebits floor price is approximately 0.52 ETH.

Key Drivers Behind Floor Price Volatility

What causes the significant swings in the Meebits floor price? The main contributing factors are:

- Market Liquidity and Sentiment: Meebits, as an early and widely recognized voxel NFT collection, experiences liquidity fluctuations driven by market sentiment. Changes in 24-hour trading volume can directly affect the lowest listed price.

- Metaverse Utility Expectations: Meebits are designed to serve as avatars in virtual worlds, making them functional NFTs. This functionality adds value beyond collectibility and may increase as the metaverse ecosystem evolves.

- IP Ownership and Community Engagement: With Yuga Labs holding the Meebits IP, the project benefits from strong branding. The active participation of the Meebits community, including groups like Meebits DAO, helps build the ecosystem and provides long-term price support.

- Macro Crypto Market Conditions: Movements in ETH prices and overall NFT market trends impact the Meebits floor price, which typically falls during bear markets and rebounds during bull runs.

Meebits Ecosystem Value and Future Prospects

- 3D Virtual Avatars: Unlike conventional profile picture (PFP) NFTs, Meebits feature detailed 3D models ideal for use in the metaverse and virtual reality (VR) environments.

- Commercial Rights: Meebits offer certain commercial rights, allowing holders or licensees to leverage them for creative and content production purposes.

- IP Value: With Yuga Labs managing the IP, Meebits has potential for deeper brand development and expansion into virtual worlds.

- Community-Driven Growth: Engagement from the Meebits community, including Meebits DAO, positions the project as more than static artwork, making it an active participant in the Web3 ecosystem.

Investment Recommendations and Risk Considerations

- Entry Timing: If you believe in the future of the metaverse and avatar-based NFTs, the current relatively low floor price could offer a long-term investment opportunity. However, a long-term perspective is required.

- Risk Factors: The NFT market is highly volatile, and liquidity may be lower than mainstream cryptocurrencies. A sharp drop in ETH price can pose increased risks. While Meebits offers metaverse utility, its commercialization and practical adoption remain uncertain.

- Diversified Analysis: Always consult multiple NFT platforms (OpenSea, Blur, CoinGecko, etc.) for price data rather than relying on a single floor price metric.

Conclusion and Outlook

To sum up, Meebits is a classic voxel NFT collection with notable market presence. Although its floor price has been volatile recently, it remains within a reasonable range. As the metaverse ecosystem expands and community involvement deepens, and as Yuga Labs continues to develop the IP, Meebits could gain new value support. For long-term investors, this is a noteworthy entry point, but investors should remain cautious about market fluctuations.

Related Articles

The New Era of the NFT Market: From Explosive Peaks to Rational Transformation

The Next 100x Coin? Low-Cap Crypto Gem Analysis

MathWallet Quick Start Guide

Zora NFT Market Update: ZORA Token Airdrop, Layer-2 Expansion, and Creator Incentive Mechanisms

Ethereum Whales Revealed: Who Are the True ETH Giants in 2025?