The Truth About Pepsi Coin: Pepsi Didn’t Issue a Token, Beware of Massive Meme Coin Losses

What Is Pepsi Coin? Why Did It Suddenly Go Viral?

Pepsi Coin suddenly became popular in the crypto community for two main reasons:

- Its high brand recognition makes it an instant attention-grabber.

- The explosive growth of meme coin ecosystems, where any token tied to a popular brand, cartoon character, or trendy icon can be quickly cloned and circulated.

Many users mistakenly assume Pepsi Coin is part of Pepsi’s official Web3 strategy. This misconception occurs because a similar name does not equal official endorsement.

Did Pepsi Really Launch a Token? Clarifying the Official Position

The answer is unequivocal—Pepsi has not issued any cryptocurrency.

PepsiCo’s only recent foray into Web3 has been limited to non-financial digital assets, such as NFT art projects like Pepsi Mic Drop. The company has never released any token, nor authorized any person or project to issue crypto under the “Pepsi” or “PepsiCo” names.

As a result, any tokens branded as PEPSI, PEPSICOIN, PEPSI ON SOL, or PEPSITOKEN are not official releases from Pepsi. They have no commercial or legal connection to PepsiCo.

In short, these projects are simply meme tokens trying to capitalize on brand hype.

Why Have Most Related Meme Coins Gone to Zero?

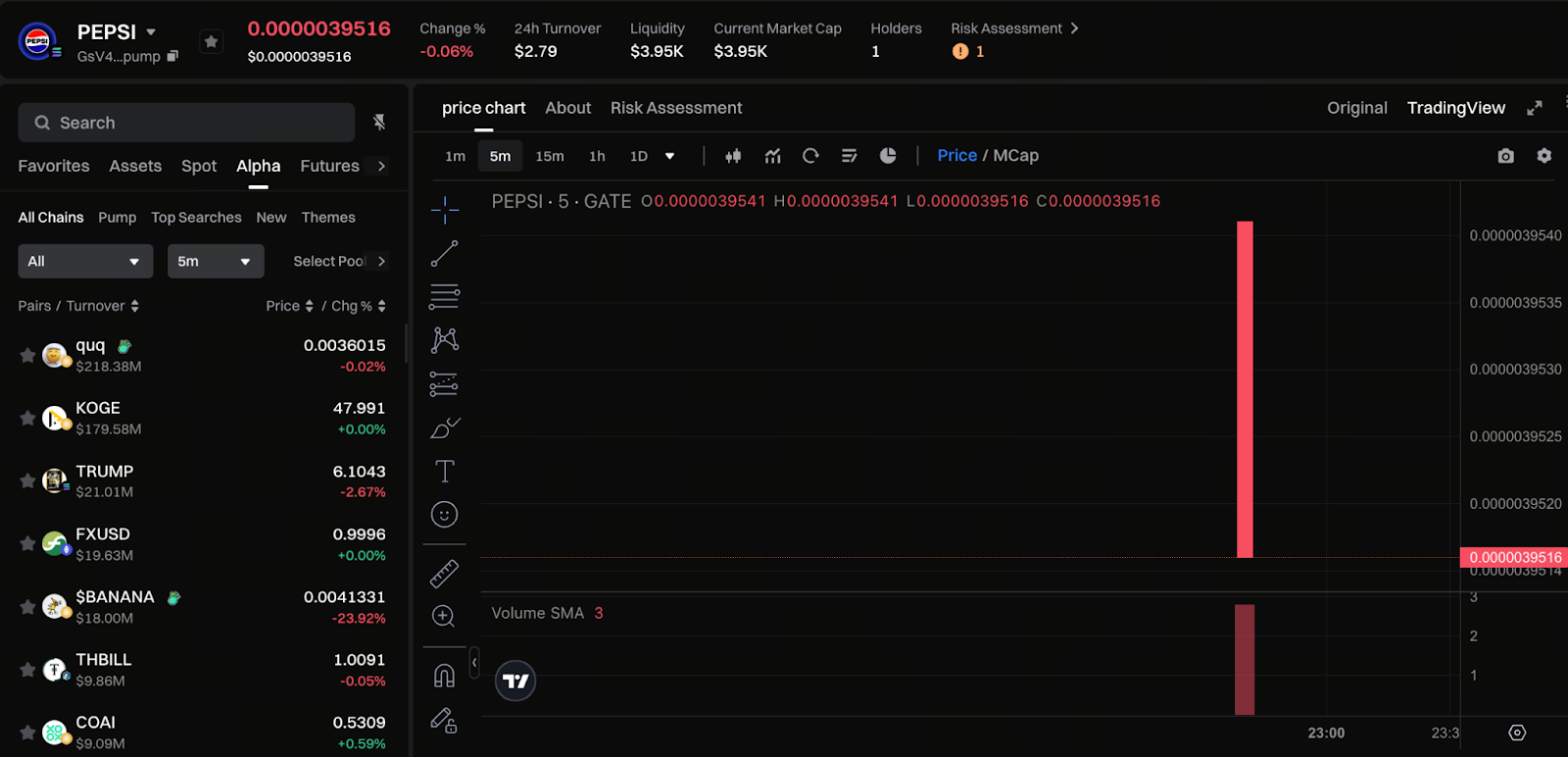

Many Pepsi-themed tokens have faced the following outcomes:

- Trading volumes have sharply decreased

- Liquidity is insufficient

- Project teams have ceased maintenance

- Some have even abandoned their communities entirely

These factors have driven prices toward zero, effectively wiping out value. The root causes include:

1. Entirely Community-Driven, With No Real Value Foundation

These tokens lack technology, ecosystem, and use cases. They rely solely on brand names for attention.

2. Meme Coins Are Inherently High-Risk and Short-Lived

Most tokens based on trending names experience rapid price swings and typically disappear within weeks.

3. Abandonment and Rug Pulls Are Commonplace

Some issuers are only seeking short-term profits, hyping the market and then dumping their holdings.

4. Brand Names Cannot Deliver Long-Term Value

These are unofficial projects that use recognizable names. Once the initial hype fades, the price collapses.

The Risk Profile of Brand-Named Tokens: Why Are They So Dangerous?

Pepsi Coin exemplifies this category of token:

Brand-Driven Meme Token

Key risks include:

- Highly misleading (users may believe a major corporation is behind it)

- Virtually no prospects for long-term development

- Significant regulatory risk (potential trademark infringement)

- Often used for short-term exploitation

- Prone to collapse and permanent loss of liquidity

In other words, the more appealing and brand-like the name—without an official statement—the higher the risk.

How Can Investors Distinguish Brand-Driven False Narratives?

1. Check Official Sources: Website, Press Releases, Official X Account

If there’s no formal token announcement, it’s almost certainly a copycat.

2. Don’t Invest Based Solely on “Familiarity”

Major brand ≠ major project; similar name ≠ official token.

3. Don’t Trust KOLs or Communities Claiming “Brand Partnerships”

More than 90% of these stories are fabricated.

4. Treat Brand Meme Coins as Pure Speculation—Never Hold Long Term

If you buy, be aware of the risk of total loss.

Conclusion: Avoid Fake Brand Tokens and Safeguard Your Assets

Pepsi Coin may seem related to Pepsi, but it is not officially associated. All brand-named tokens are community creations, most have already collapsed to zero, and they represent classic high-risk meme coins. If you want to participate in meme coins, treat it as entertainment. If you’re seeking value investments, always verify official sources.

Related Articles

The New Era of the NFT Market: From Explosive Peaks to Rational Transformation

The Next 100x Coin? Low-Cap Crypto Gem Analysis

MathWallet Quick Start Guide

Zora NFT Market Update: ZORA Token Airdrop, Layer-2 Expansion, and Creator Incentive Mechanisms

Ethereum Whales Revealed: Who Are the True ETH Giants in 2025?