Ethereum Whales Revealed: Who Are the True ETH Giants in 2025?

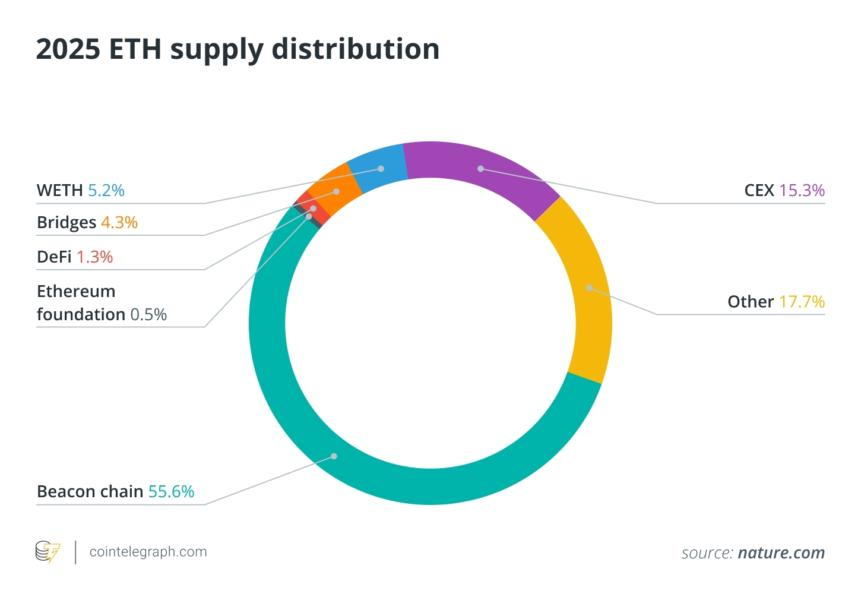

By 2025, Ethereum’s (ETH) wealth distribution has undergone significant transformation. The traditional image of Ethereum co-founder Vitalik Buterin or early ICO whales at the top no longer applies—smart contracts (protocols), exchanges, and institutional funds now lead the rankings.

Ethereum’s Whale Wave: Beyond Individuals

On-chain data shows that by mid-2025, the top 10 ETH addresses hold more than 60% of the circulating supply. Importantly, these addresses are primarily held by smart contracts (protocols), exchanges, and institutional funds, rather than individuals.

Beacon Deposit Contract: Holding Over Half the Supply

At the center is the Beacon Deposit Contract, the primary deposit contract for validators to deposit ETH into the Ethereum Proof-of-Stake (PoS) network. Analyses estimate this contract holds about 58.88 million ETH (figures vary by source), representing more than half of Ethereum’s total circulating supply. This protocol-level holding makes the network itself a critical force in Ethereum’s economic structure.

Exchange Wallets and Custodians: Key Roles

Beyond protocol contracts, major cryptocurrency exchanges are major players on the Ethereum rich list. On-chain analytics reveal that exchanges like Coinbase and Binance collectively hold millions of ETH in their wallets. These assets support customer deposits and withdrawals; liquidity provision; staking derivatives; and related services.

Institutions Enter the Market: BlackRock, Fidelity, and Other Giants

Institutional investors are playing an increasingly pivotal role in the ETH market. Funds such as BlackRock’s iShares Ethereum Trust (ETHA) and Fidelity’s Ethereum Fund (FETH) hold substantial ETH positions. More corporations are holding ETH as a treasury asset, according to analysis, and earning yields through staking.

Early Whales and Notable Individuals: Vitalik, Lõhmus, and Others

Although protocols and institutions hold most ETH, individual whales still play a significant role.

- Vitalik Buterin (Ethereum co-founder) is estimated to hold between 250,000 and 280,000 ETH.

- Rain Lõhmus (LHV Bank partner) acquired around 250,000 ETH during the ICO phase but reportedly cannot access the wallet.

- Joseph Lubin (ConsenSys co-founder) reportedly retains a significant ETH balance (hundreds of thousands).

Other early figures, such as Anthony Di Iorio, are said to hold between 50,000 and 100,000 ETH.

Risks and Centralization: Underlying Concerns on the Rich List

Such concentrated wealth distribution raises several concerns.

- Risk of protocol concentration: With the Beacon Deposit Contract holding over half of all ETH, any protocol-level vulnerability or mass exit of validators could have wide-reaching consequences.

- Liquidity constraints: Although exchanges hold large ETH reserves, most are held in custodial wallets and are not immediately accessible to individual users.

- Centralization trend: The significant control of ETH by institutions and major funds sparks ongoing debate about whether this undermines the core principle of decentralization in cryptocurrency.

Tracking ETH Distribution: Tools and Methods

To track the latest ETH distribution, the following tools are recommended:

- Nansen Token God Mode: Tracks wallet categories such as exchanges, funds, and smart contracts.

- Dune Analytics: Enables users to create custom dashboards showing the top 200 wallet distributions.

- Etherscan: Although wallet ownership cannot always be confirmed, address tags such as exchange, staking contract, or fund provide valuable insights.

Related Articles

The New Era of the NFT Market: From Explosive Peaks to Rational Transformation

The Next 100x Coin? Low-Cap Crypto Gem Analysis

MathWallet Quick Start Guide

Zora NFT Market Update: ZORA Token Airdrop, Layer-2 Expansion, and Creator Incentive Mechanisms

Bitcoin Whale Moves Analysis: Why Are Big Transactions Frequent Recently?