How to Trade Tokens on Raydium: The Latest 2025 Step-by-Step Guide

Raydium: Overview and Core Features

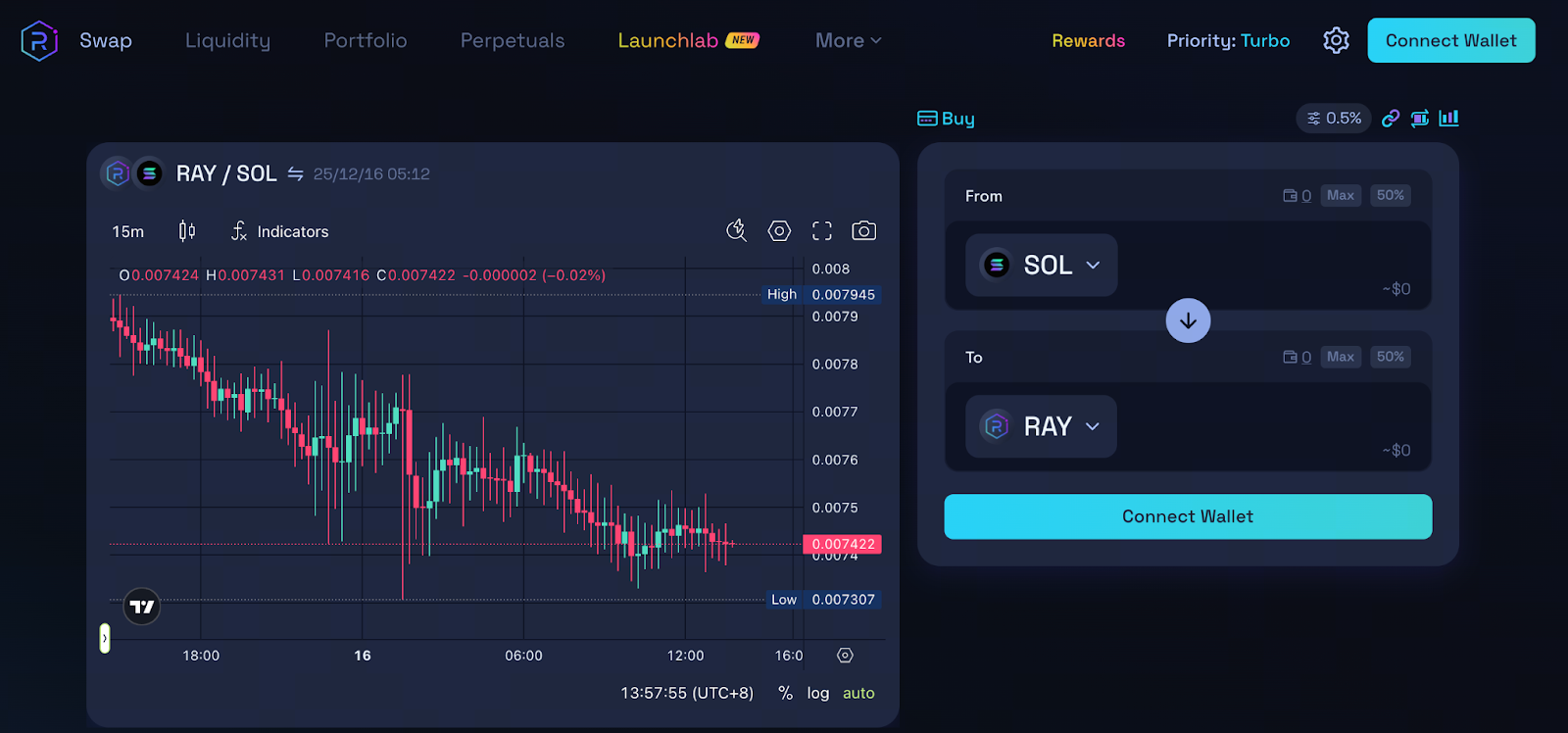

Image source: https://raydium.io/swap/?inputMint=sol&outputMint=4k3Dyjzvzp8eMZWUXbBCjEvwSkkk59S5iCNLY3QrkX6R

Raydium is a decentralized exchange (DEX) and automated market maker (AMM) built on the Solana blockchain. Its primary advantage is the integration of AMM functionality with the Serum order book, giving traders access to deeper liquidity and enabling fast, low-cost token transactions.

Key features of Raydium include:

- Token swaps (trading/exchanging)

- Liquidity provision for fee earnings

- Farming and LP rewards

- Perpetual futures (test version)

- Token launches and IDO participation

Recently, Raydium introduced a perpetual futures beta, attracting increased derivatives trading volume.

Market Trends and Price Action

As of the latest update, RAY has been trending weak, with its price fluctuating between support and resistance levels. Traders should closely monitor short-term price swings and trend signals. Technical analysis suggests the price may range between $0.95 and $1.17 over the near term.

Trade now: https://www.gate.com/trade/RAY_USDT

Market data shows strong trading volume on Raydium, along with the rollout of new trading types like perpetual futures in beta. These developments may shape user behavior and influence trading strategies.

Raydium Trading Essentials: Getting Started

To trade on Raydium, you need to prepare the following:

- Solana-compatible wallet: Examples include Phantom, Solflare, Gate, and other supported crypto wallets.

- Fund your wallet: Acquire SOL for network fees and deposit the tokens you intend to trade.

- Visit Raydium’s official website and connect your wallet: Click “Connect Wallet” and approve the connection. Once connected, you’re ready to trade.

How to Swap and Place Limit Orders on Raydium

Standard Swap (Instant Transactions)

This is Raydium’s most basic trading process:

- Go to the Swap page

- Select your sell and buy token pair (e.g., SOL → USDC)

- Enter the amount

- Review estimated slippage and price impact

- Confirm the transaction and approve it in your wallet

The process is quick and straightforward, ideal for fast execution.

Limit Orders

Limit orders allow users to set trades at a specific price, but require configuration on the dedicated trading panel:

- Select the trading pair

- Set your price and amount

- Submit the order and wait for execution

Some users note that the limit order feature on the official site could be improved. Many prefer Jupiter or other aggregators for more advanced limit order management.

Liquidity and DeFi Utilities on Raydium

In addition to token trading, Raydium offers:

- Liquidity pools: Deposit token pairs to earn trading fees and rewards.

- LP token farming: Stake LP tokens for additional RAY rewards.

- IDO / AcceleRaytor participation: Hold RAY to join new token launch events.

These features extend Raydium’s decentralized finance capabilities.

Risk Disclosure and Frequently Asked Questions

While Raydium is user-friendly, decentralized finance comes with inherent risks:

- Price volatility: RAY and other tokens can be highly volatile, posing short-term risks.

- Slippage and failed trades: Transactions may not always execute at expected slippage.

- Smart contract and platform risks: DeFi protocols are susceptible to attacks or vulnerabilities.

Always implement robust risk management strategies before trading.

Conclusion and Practical Advice

To master trading tokens on Raydium, focus on the following:

- Set up a compatible wallet and acquire SOL for fees

- Learn basic swap operations

- Utilize limit orders and advanced features

- Continuously monitor market price and platform risks

With ongoing platform upgrades—such as the addition of perpetual futures—Raydium remains a key gateway for new token trading and a major player in the DeFi ecosystem.

Related Articles

The New Era of the NFT Market: From Explosive Peaks to Rational Transformation

The Next 100x Coin? Low-Cap Crypto Gem Analysis

Best Crypto Wallets to Watch in 2025: Top Picks for Security and Convenience

MathWallet Quick Start Guide

Zora NFT Market Update: ZORA Token Airdrop, Layer-2 Expansion, and Creator Incentive Mechanisms