What Are Fractional NFTs? Understanding the Mechanics of NFT Fractionalization and Its Real-World Use Cases

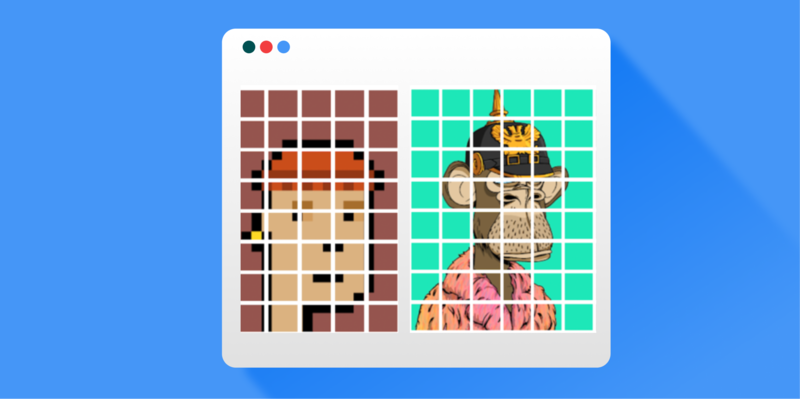

What Are Fractional NFTs

Fractional NFTs are created by dividing a single, indivisible NFT into multiple tradable “fractional tokens” using smart contracts. This process enables several users to share ownership rights to the NFT.

These fractions are typically represented by fungible tokens, such as ERC-20 tokens, with each token signifying a portion of the NFT’s ownership. The original NFT is locked in a smart contract until one party acquires all the fractions and can redeem the complete NFT.

Technically, fractional NFTs do not constitute a new NFT type; rather, they represent a reconfiguration of NFT ownership structures.

How NFT Fractionalization Works

Currently, the mainstream approach to fractional NFTs generally involves the following steps:

- The user deposits the entire NFT into a fractionalization smart contract.

- The contract mints a predetermined number of divisible tokens.

- These tokens can be freely traded on platforms or decentralized exchanges (DEXs).

- When a single address collects all tokens, the complete NFT can be redeemed.

This mechanism essentially combines NFT locking, tokenization, and fractional trading into one structure.

Real-World Problems Addressed by Fractional NFTs

First, the barrier to entry: High-value NFTs can cost tens of thousands of dollars or more, making them inaccessible to most users. Fractional NFTs allow users to participate with smaller investments.

Second, liquidity: Whole NFTs often require longer transaction cycles, while fractional tokens are easier to trade.

Third, asset allocation: Fractionalization enables users to allocate the same capital across different NFT fractions, rather than concentrating risk in a single asset.

It is important to note that fractional NFTs solve transaction structure challenges, not the underlying value of NFTs.

Common Application Scenarios

Currently, fractional NFTs are mainly applied in the following areas:

- High-value digital art: Multiple parties co-own expensive works

- Virtual land and metaverse assets: Lowering the entry threshold for virtual real estate

- IP collectible NFTs: Dividing scarce assets into tradable units

- DAO asset co-ownership: Communities or organizations jointly hold NFTs

These use cases remain in the exploratory stage and have yet to develop into highly standardized business models.

Advantages and Limitations of Fractional NFTs

Key advantages:

- Lowers the entry barrier for high-value NFTs

- Enhances trading flexibility

- Supports co-ownership and community management

- Facilitates diversified portfolio allocation

Key limitations:

- Liquidity is not guaranteed by default

- Fractional token prices are closely tied to the valuation of the original NFT

- Co-ownership can introduce governance complexity

- Legal and copyright boundaries remain undefined

As such, fractional NFTs are best used as supplementary tools, not as a mainstream trading model.

Current Market Stage

Across the NFT industry, the market has entered a more rational development phase. Fractional NFTs currently represent:

- A niche segment with a limited user base

- Shallow trading depth

- Reliance on liquidity from individual projects

- No unified industry standards

This shows that fractional NFTs remain in an early, tool-oriented phase and are still some distance from widespread adoption.

Who Should Consider Fractional NFTs?

Fractional NFTs are better suited for the following users:

- Those seeking to invest small amounts in NFTs

- Individuals interested in high-value NFTs but with limited capital

- Participants in DAOs or community asset co-ownership

- Digital asset holders focused on portfolio diversification

They are not suitable for speculative traders relying solely on short-term price swings for returns.

Conclusion

Fractional NFTs are not the primary growth engine of the NFT industry. Instead, they are a structural solution developed to address liquidity, accessibility, and co-ownership needs. Over the long term, they are likely to serve as foundational tools within the NFT ecosystem, rather than as a mainstream standalone sector.

Related Articles

The New Era of the NFT Market: From Explosive Peaks to Rational Transformation

The Next 100x Coin? Low-Cap Crypto Gem Analysis

Best Crypto Wallets to Watch in 2025: Top Picks for Security and Convenience

MathWallet Quick Start Guide

Zora NFT Market Update: ZORA Token Airdrop, Layer-2 Expansion, and Creator Incentive Mechanisms