What Is Jupiter? A Complete Guide to Solana’s Leading Decentralized Exchange Aggregator

What Is Jupiter DEX?

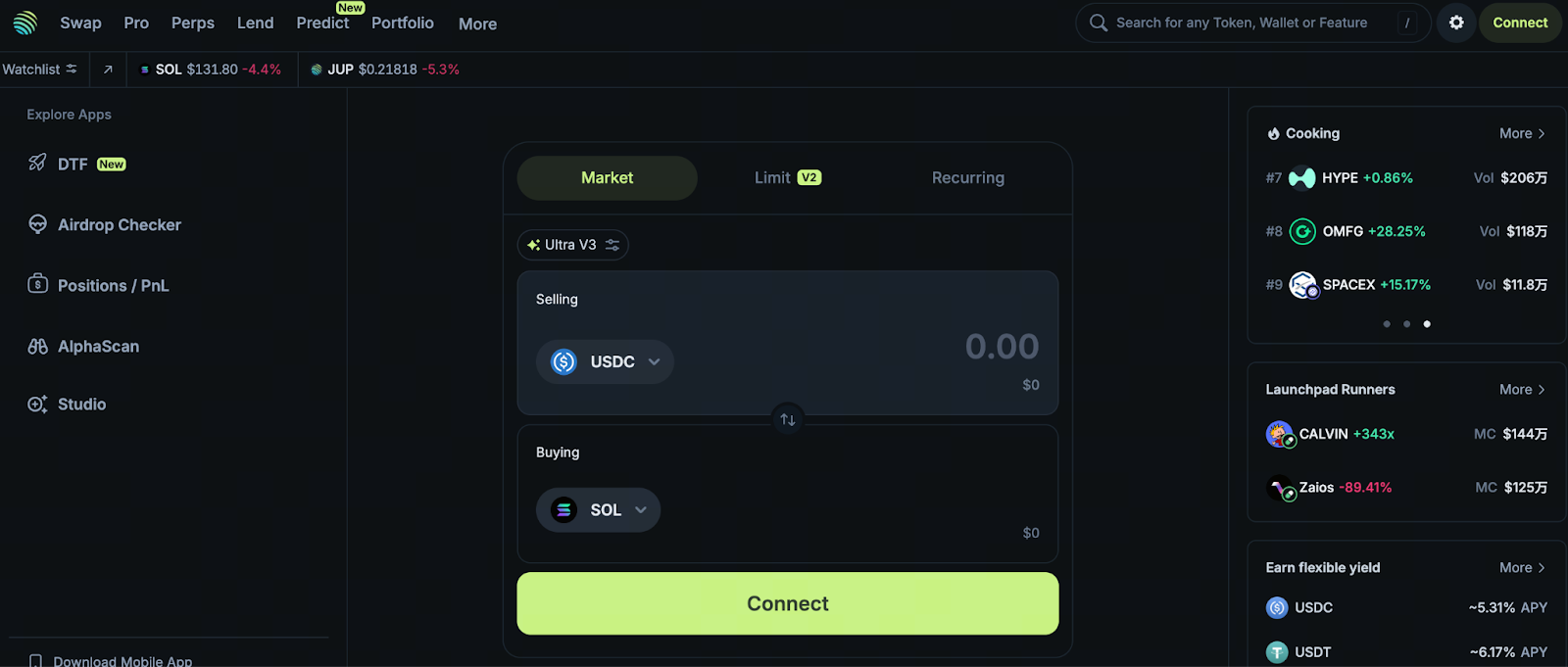

Image source: https://jup.ag/

Jupiter stands as the leading decentralized exchange aggregator (DEX Aggregator) in the Solana ecosystem. Think of it as the “Web3 price comparison engine”: whenever users want to swap two tokens on Solana, Jupiter scans all liquidity sources—AMMs, liquidity pools, order books, and more—to identify the most efficient route. This ensures users secure the best price, minimal slippage, and the fastest execution.

Unlike traditional AMMs, Jupiter doesn’t operate its own pools. Instead, it aggregates liquidity across the entire network, letting users swap tokens at the lowest possible cost.

Core Features and Design Philosophy of Jupiter

Jupiter’s design centers around three clear objectives:

- Deliver the best possible execution price for users

- Automatically select the optimal route, removing the need for manual comparisons

- Fully leverage Solana’s low transaction costs

Jupiter is much more than a simple swap page. It’s a scalable routing system that empowers users, developers, and trading bots to achieve optimal execution on Solana.

Jupiter’s slogan captures its mission: Best Routes. Best Prices. On Solana.

Why Is Jupiter So Important in the Solana Ecosystem?

Jupiter’s significance comes from its position as the default trading gateway on Solana. Key reasons include:

- Solana hosts numerous AMMs and DEXs, leading to fragmented liquidity

- It’s difficult for users to compare prices manually

- Large trades require precise slippage management

- Liquidity is highly volatile for new token launches, making rapid price discovery essential

- Wallets and DEXs integrate Jupiter’s routing system

As a result, Jupiter is more than just a website—it’s a critical layer of infrastructure, widely integrated into wallets like Phantom, Backpack, Tensor, and many DeFi applications.

Route Optimization: How Does Jupiter Secure the Best Price?

Route optimization is at the heart of Jupiter and forms its technical moat.

When a user enters “Token A → Token B,” Jupiter follows this process:

1. Search All Available Liquidity Pools

This includes Raydium, Orca, Phoenix, Meteora, Lifinity, and others.

2. Simulate Each Route and Compute:

- Slippage

- Fees

- Pool depth

- Actual executable volume

- Multi-hop route returns

3. Automatically Select the Most Cost-Effective Route

For example, instead of a direct A → B swap, Jupiter might find that A → C → B is more cost-efficient and will execute the multi-hop route automatically.

4. Display Route Results to the User

Users simply confirm to complete the entire routing process. This makes Jupiter the preferred aggregator for professional market makers, arbitrageurs, and retail users alike.

Jupiter’s Interface and Trading Experience

Jupiter’s interface is clean and intuitive, offering an experience similar to instant swaps on centralized exchanges:

- Input tokens

- Select amount

- View route suggestions

- One-click Swap

Jupiter also offers several standout features:

Price Impact Alerts

Warns users if the trade size may cause significant price movement.

Customizable Slippage

Ideal for large traders and trading bots.

Token List Auto-Filters Scam Tokens

Helps users avoid accidental purchases of malicious tokens.

Advantages: Fees, Slippage, and Security

Jupiter does not charge any extra fees (other than a minimal routing maintenance fee). Users mainly pay Solana network and AMM fees.

The advantages are substantial:

- Solana network fees are virtually zero

- Slippage on large trades is often much lower than on a single AMM

- The protocol never holds user assets, eliminating centralization risk

- Smart contracts have passed multiple audits

For users seeking ultra-low cost and high-frequency trading, Jupiter is the top choice on Solana.

The Role of the JUP Token in Jupiter

Jupiter has its own ecosystem token, JUP, which serves the following main functions:

- Governance (DAO voting) for routing strategies, incentive programs, and product direction

- Ecosystem incentives, such as user rewards and incentives for liquidity providers

- Long-term protocol value capture: as trading volume grows, additional token value mechanisms may be introduced

As of December 11, 2025, JUP is priced at approximately $0.22, with significant recent volatility. Trade it here: https://www.gate.com/trade/JUP_USDT

Jupiter’s Future and Expansion Plans

Jupiter aims to be more than just a swap tool, expanding into offerings such as:

- Perpetual contract trading (Perps)

- Jupiter Terminal (an embeddable trading interface for other projects)

- Advanced data and analytics tools

- DeFi automation strategy tools

Jupiter’s goal is to become the Solana Liquidity Hub—a comprehensive trading ecosystem on Solana, much like “Uniswap + 1inch + GMX” for Solana.

Summary: Why Is Jupiter Seen as Solana’s Trading Hub?

In summary, Jupiter is recognized as the core of Solana DeFi because of:

- Exceptional routing efficiency

- Comprehensive liquidity aggregation

- Low transaction costs

- Outstanding product experience

- Widespread adoption across the Solana ecosystem

- Ongoing feature releases and expansion

For anyone looking to trade on Solana, Jupiter is an indispensable tool.

関連記事

The New Era of the NFT Market: From Explosive Peaks to Rational Transformation

The Next 100x Coin? Low-Cap Crypto Gem Analysis

Best Crypto Wallets to Watch in 2025: Top Picks for Security and Convenience

MathWallet Quick Start Guide

Zora NFT Market Update: ZORA Token Airdrop, Layer-2 Expansion, and Creator Incentive Mechanisms