What Is Meteora? An In-Depth Analysis of the Dynamic Liquidity Protocol on Solana

What Is Meteora?

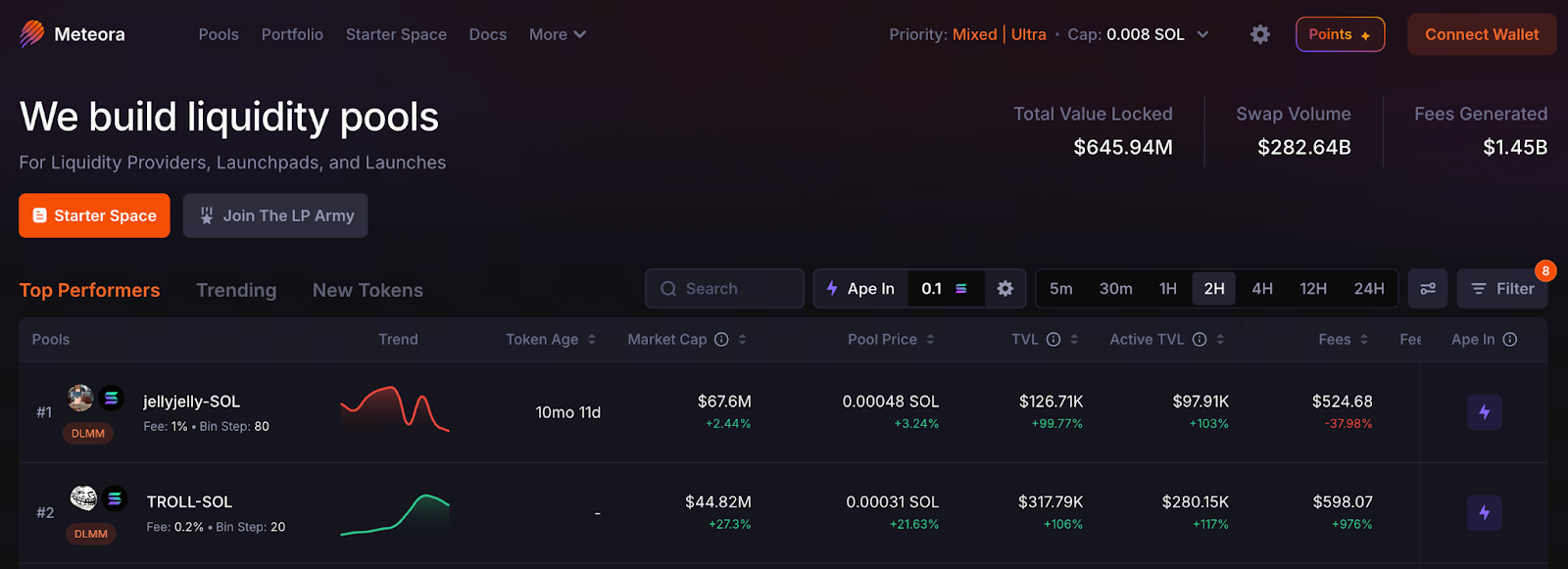

Image: https://www.meteora.ag/?tab=top

Meteora is a foundational protocol in the Solana ecosystem that delivers dynamic liquidity. Unlike standard AMMs, Meteora’s core innovation is its ability to automatically adjust pool depth, range, and fees in real time based on market conditions. This approach enables more efficient trading, reduces slippage, and maximizes liquidity utilization.

Meteora aims to serve as the liquidity hub for the Solana ecosystem, streamlining the launch, pool creation, and capital attraction process for every new project. It’s not just a protocol tool—it’s a critical piece of infrastructure driving Solana’s ongoing expansion.

What Problem Does the Project Solve?

Traditional AMMs, such as Uniswap V2, face several persistent challenges:

- Low capital efficiency: significant liquidity remains idle in inactive price bands.

- High slippage: insufficient depth in high-volume trading zones.

- Poor LP experience: returns are unstable and risks are elevated.

- High launch barriers for new projects: initial liquidity setup is complex and prone to front-running.

Meteora’s dynamic architecture addresses these issues by intelligently reallocating liquidity to high-activity trading zones. This ensures capital is used more efficiently and trades execute more smoothly.

Core Features and Technical Highlights

1. Dynamic Liquidity Pool

Pools no longer require manual range settings. The system automatically adjusts depth based on market price movements. Benefits include reduced impermanent loss and improved capital efficiency.

2. Dynamic Fee Model

Trading fees automatically scale with market volatility:

- High volatility → Higher fees to deter front-running

- Low volatility → Lower fees to stimulate trading volume

3. Launch Mechanics for Project Tokens

Meteora enables new projects to rapidly deploy optimized liquidity pools, with integrated front-running protection.

4. Flexible LP Strategies

LPs can target more active ranges, boosting yield potential and pool stability.

Utility of the MET Token

MET is Meteora’s core ecosystem token, with primary utilities including:

- Governance: Vote on protocol parameters, incentive structures, and future features.

- Ecosystem Incentives: Earn MET rewards by providing liquidity or participating in ecosystem activities.

- Fee Discounts and Feature Unlocks: Certain advanced features and future modules may require MET for fee payments or unlocks.

- Value Alignment: As protocol trading volume and TVL grow, demand for MET increases accordingly.

Token supply follows a clearly defined medium- to long-term growth plan. Unlock and emission schedules will gradually fall under community governance.

Latest Market Price and Exchange Performance

MET is actively traded on several exchanges, including major platforms like Gate, maintaining strong volume.

As of December 12, 2025, MET trades in a range of $0.26 to $0.33, reflecting moderate volatility.

Trade MET here: https://www.gate.com/trade/MET_USDT

Key factors influencing price include:

- Changes in Solana ecosystem momentum

- Adoption of Meteora by new projects

- Liquidity pool TVL fluctuations

- Overall market risk sentiment

Because Meteora serves as the liquidity foundation for new Solana projects, market demand for the protocol grows with the ecosystem, which in turn drives the long-term value of MET.

Opportunities and Risks of Investing in Meteora

Opportunities:

- Built on Solana’s high-speed blockchain, offering significant ecosystem growth potential

- Protocol addresses real-world use cases (launches, DEX liquidity)

- Dynamic mechanisms provide a technical edge over traditional AMMs

- Ample exchange liquidity ensures seamless trading

- Attracts more DeFi and meme projects to the ecosystem

Risks:

- Market volatility can impact MET’s price

- Complex liquidity mechanisms may present a learning curve for average users

- The protocol is still scaling, so long-term operational performance remains to be seen

- Concentrated token unlocks could exert selling pressure

Related Articles

The New Era of the NFT Market: From Explosive Peaks to Rational Transformation

The Next 100x Coin? Low-Cap Crypto Gem Analysis

Best Crypto Wallets to Watch in 2025: Top Picks for Security and Convenience

MathWallet Quick Start Guide

Zora NFT Market Update: ZORA Token Airdrop, Layer-2 Expansion, and Creator Incentive Mechanisms