What Is Sidra Chain? A Decentralized Network Balancing Compliance and Blockchain

What Is Sidra Chain?

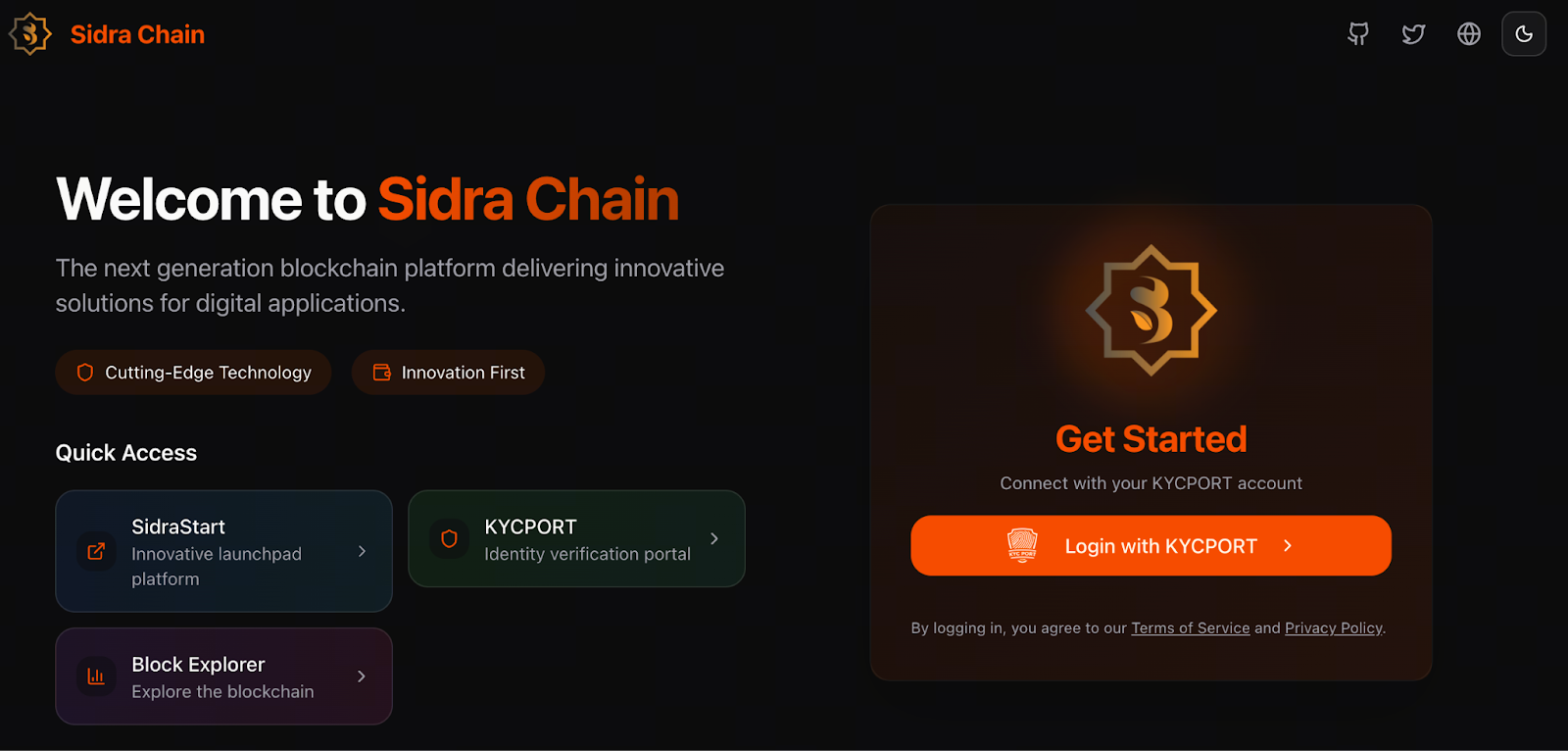

Image: https://www.sidrachain.com/login

Sidra Chain is a blockchain ecosystem built on the principles of “compliance + blockchain,” designed to deliver ethical, transparent, and decentralized (DeFi) financial infrastructure for Muslims and those seeking Shariah-compliant solutions. Rather than following DeFi trends, Sidra Chain integrates traditional Islamic finance principles with advanced blockchain technology.

Sidra Chain launched in 2022, and its MainNet went live in October 2023.

Sidra Chain: Core Philosophy and Design Features

- Shariah Compliance: Sidra Chain’s architecture eliminates interest (riba), excessive uncertainty (gharar), and prohibits investments in industries deemed haram, such as alcohol and gambling. Smart contracts and financial products—including Sukuk (Islamic bonds) and Murabaha (cost-plus-profit financing)—operate strictly within this compliance framework.

- Blockchain, Decentralization, Smart Contracts, and Transparent Ledger: Built on an Ethereum fork, Sidra Chain uses a Proof-of-Work (PoW) consensus mechanism. All blockchain records are open and transparent, allowing for full verification of transactions and contracts.

- Lower Barriers and Accessibility: Sidra Chain enables users to join the network, mine (or validate), and access wallets and application services directly from mobile devices—significantly reducing the need for costly mining hardware.

- Comprehensive Ecosystem: Beyond the blockchain network, Sidra Chain offers a suite of tools, including a wallet, identity verification systems (KYCPORT), a launchpad (SidraStart) for token and project launches, and an explorer for on-chain data access by users and developers.

MainNet Status and Ecosystem Overview

- MainNet Launch: Sidra Chain’s MainNet officially began operations in October 2023.

- Wallet and Ecosystem Tools: The official wallet, KYC verification (KYCPORT), block explorer, and SidraStart launchpad support project and token issuance and launches.

- Compliant Decentralized Finance (DeFi) Architecture: Sidra Chain provides Shariah-compliant DeFi options, including Islamic bonds (Sukuk), compliant financing (Murabaha), cross-border payments, and Shariah-compliant supply chain solutions.

SDA Token Issuance and Circulation — Is It Available?

Sidra Chain’s native token is SDA. SDA is used for transactions, miner rewards, payment of on-chain service fees, and participation in the ecosystem and projects.

Currently, major exchanges do not display SDA’s price or market data, resulting in extremely limited or inactive public circulation and trading. Where circulation is possible, strict KYC verification is typically required for mining, trading, or claiming tokens.

Recent Developments and 2025 Initiatives

- KYC Expansion Pilot: The Sidra Chain team launched a pilot program in Pakistan to expand user onboarding through compliant identity verification.

- Decentralized Exchange (DEX) Initiative: The team aims to enhance token liquidity and trading efficiency, with plans to list SDA on global exchanges.

- Community Engagement: The project’s focus on compliance, blockchain, and decentralized finance (DeFi) has sparked interest, positioning Sidra Chain as a bridge between traditional finance and cryptocurrency.

Risks and Considerations

- Liquidity and Exchange Support: SDA is not widely available on major exchanges, making it difficult to liquidate quickly.

- KYC and Compliance Barriers: Mining, trading, and acquiring tokens generally require verified identity.

- Transparency and Community Feedback: Users have criticized delays in KYC, wallet connectivity issues, trading functionality, and liquidity constraints.

- Narrow Market Focus: Sidra Chain primarily targets the Shariah-compliant market, which may limit its growth prospects.

- Competition and Uncertainty: The long-term success of Sidra Chain depends on the ecosystem’s development and adoption.

Summary and Insights

Sidra Chain is a purpose-driven blockchain project that combines Islamic finance principles with decentralized finance, offering compliant alternatives to users seeking ethical financial solutions.

The MainNet is live, and SDA serves as the ecosystem token, but public market circulation is still limited. Investors may find Sidra Chain more suitable for long-term monitoring and value-driven investment than for short-term speculation.

Investors should closely follow official updates, DEX launches, and circulation status. Community feedback is also important to evaluate potential opportunities and risks.

Related Articles

The New Era of the NFT Market: From Explosive Peaks to Rational Transformation

The Next 100x Coin? Low-Cap Crypto Gem Analysis

MathWallet Quick Start Guide

Zora NFT Market Update: ZORA Token Airdrop, Layer-2 Expansion, and Creator Incentive Mechanisms

Ethereum Whales Revealed: Who Are the True ETH Giants in 2025?