What Is stETH? A Complete Guide to Lido Liquid Staking

What Is stETH?

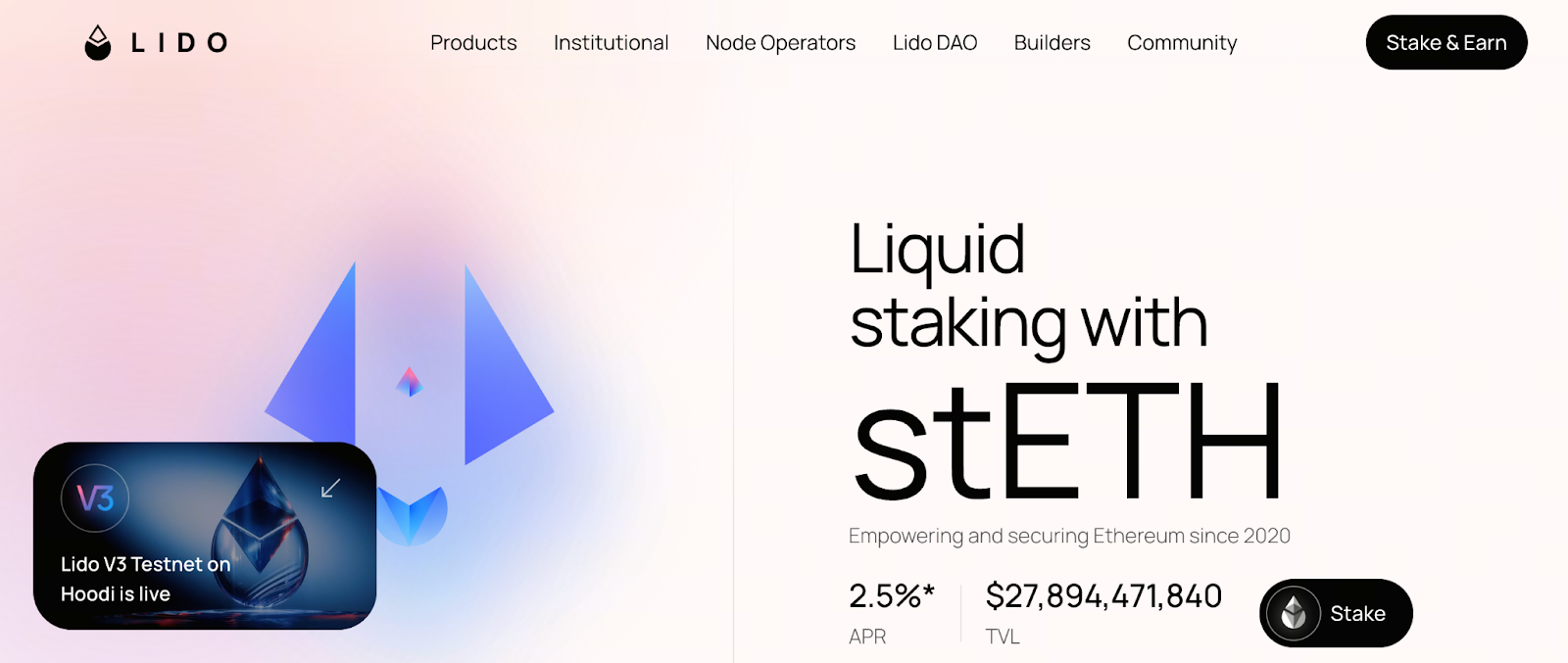

Image: https://lido.fi/

stETH is a liquid staking token issued by Lido Finance (Lido). When you deposit ETH and stake it through the Lido platform, you receive an equal amount of stETH as a receipt. stETH fundamentally represents both your staked ETH and the staking rewards it generates.

Traditional ETH staking usually requires locking up your assets, a minimum of 32 ETH, and restricts liquidity during the lock-up period. stETH eliminates these barriers—you don’t need 32 ETH or to run your own validator node. By depositing even a small amount of ETH, you can receive stETH and earn staking rewards.

How Does stETH Work?

When you deposit ETH into Lido’s smart contract, the protocol mints an equivalent amount of stETH tokens. The stETH supply is pegged 1:1 to the amount of staked ETH. Over time, your stETH balance accrues staking rewards automatically—so even if the number of stETH in your wallet doesn’t change, its value increases as rewards accumulate.

Because stETH is a liquid token, you can trade it, use it as collateral for lending, or deploy it in DeFi platforms for yield farming—just like any other cryptocurrency. This means you earn staking rewards without giving up liquidity.

For broader DeFi compatibility, there’s also a “wrapped” version called wstETH. Unlike stETH, wstETH maintains a fixed (non-rebasing) balance, making it easier to use in lending protocols, liquidity pools, and other DeFi applications.

Why Are More People Choosing to Stake ETH?

Since Ethereum (ETH) transitioned to Proof-of-Stake (PoS), many users who previously avoided staking due to high minimums and illiquidity can now participate. Lido’s stETH addresses these challenges—there’s no need for 32 ETH, no technical maintenance, and no long lock-up period. You can stake and earn rewards with ease.

stETH also offers strong liquidity—you can buy and sell it on secondary markets or use it across DeFi protocols, providing significant flexibility. This is highly attractive for users who want both yield and liquidity.

stETH Price and Liquidity Analysis (2025 Update)

Recent data shows that stETH remains one of the dominant liquid staking tokens in the Ethereum ecosystem, with robust liquidity and high utilization rates.

However, while stETH is theoretically pegged 1:1 to ETH, its market price can sometimes trade below ETH due to factors such as secondary market dynamics, supply and demand, liquidity, and market sentiment. This means stETH may trade at a discount to its ideal redemption value.

For long-term holders, these price fluctuations have minimal impact on overall returns, as staking rewards continue to accumulate. Short-term traders, however, should pay close attention to price and redemption ratio volatility.

Advantages and Risks of Using stETH

Advantages:

- Low barrier to entry—no need for 32 ETH or to operate a validator.

- High liquidity—stETH can be traded, used as DeFi collateral, or borrowed.

- Combines yield and flexibility—earn staking rewards while maintaining control over your assets.

- DeFi compatibility—the wrapped version, wstETH, is especially easy to integrate with lending protocols, liquidity pools, and more.

Risks / Considerations:

- Market volatility/discount risk—stETH may trade below ETH and is not always 1:1.

- Smart contract & protocol risk—both stETH and wstETH rely on smart contracts and the Lido protocol; any issues could pose risks.

- Liquidity event impact—in extreme market conditions or during large-scale redemptions, stETH prices can be significantly affected.

Summary and Outlook

For those who want to stake Ethereum without locking up their assets, stETH offers a flexible, low-barrier solution that balances liquidity and yield. It’s especially valuable for medium- and long-term investors and DeFi users, with stETH and wstETH providing practical utility.

Looking ahead, as DeFi evolves, support for liquid staking derivatives (LSDs) expands, and demand for flexible yield tools grows, stETH is likely to remain a key player. However, users should remain aware of market volatility and protocol risks. For newcomers, it’s wise to diversify and avoid concentrating all assets in a single token.

In summary, stETH stands out as a robust and flexible staking solution within the Ethereum ecosystem and is well worth monitoring.

Related Articles

The New Era of the NFT Market: From Explosive Peaks to Rational Transformation

The Next 100x Coin? Low-Cap Crypto Gem Analysis

Best Crypto Wallets to Watch in 2025: Top Picks for Security and Convenience

MathWallet Quick Start Guide

Zora NFT Market Update: ZORA Token Airdrop, Layer-2 Expansion, and Creator Incentive Mechanisms