What Is TVL: Understanding Total Value Locked and Its Importance in DeFi

Definition and Calculation of TVL

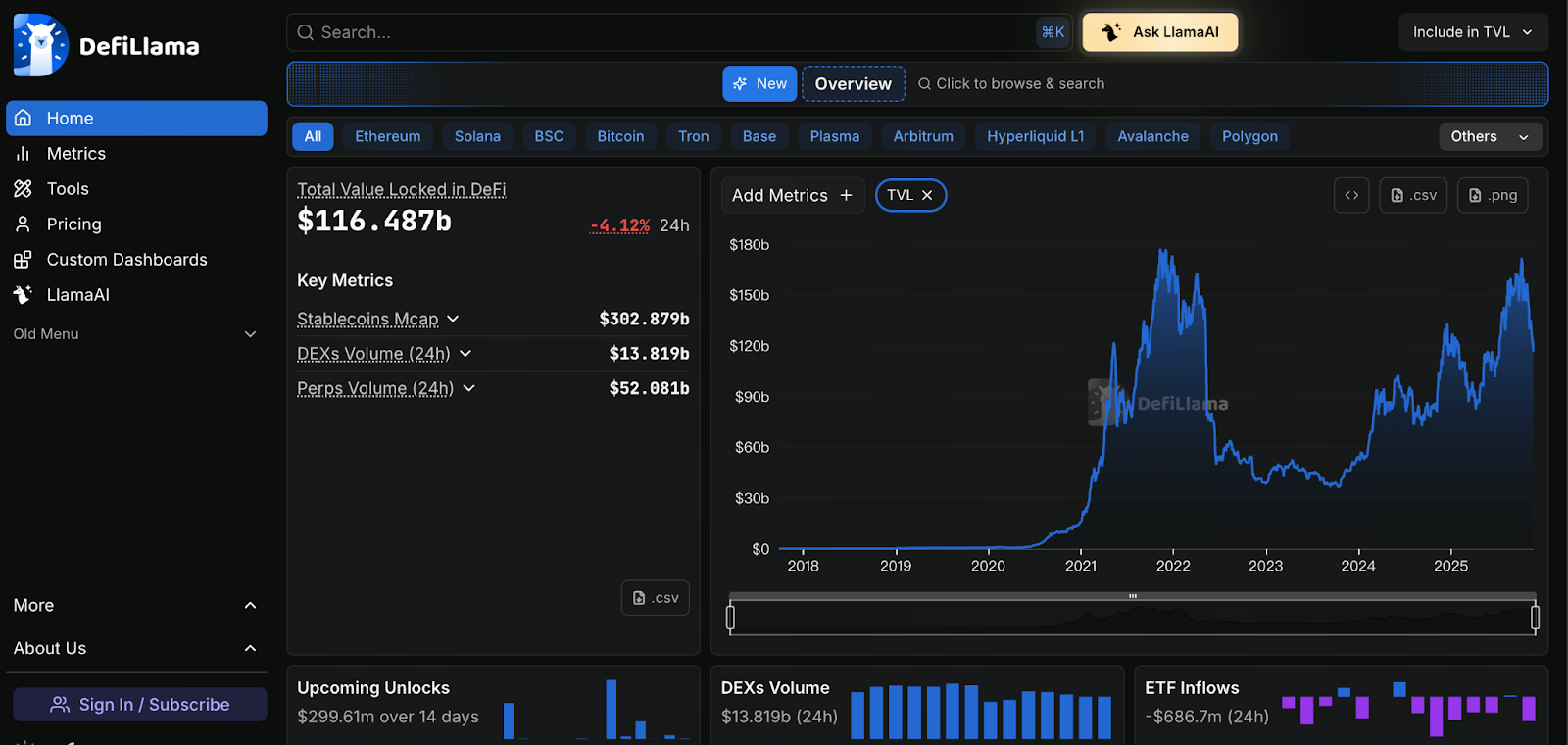

Image source: https://defillama.com/

TVL, or Total Value Locked, represents the total value of assets locked within a DeFi protocol. It is typically denominated in US dollars and indicates the aggregate amount of crypto assets that users have deposited into the protocol.

The standard calculation is: TVL = Amount of assets locked in the protocol × Current market price

For instance, if a user deposits 100 ETH into a lending protocol and ETH is priced at $2,000, that deposit contributes $200,000 to the TVL.

The Role of TVL in the DeFi Ecosystem

- Measuring liquidity: TVL is a key metric for evaluating the liquidity of a DeFi protocol. Higher TVL generally means the protocol holds more assets and users, supporting greater trading and lending volumes.

- Assessing project health: TVL provides insight into a project’s popularity and credibility. Consistent growth in locked assets usually signals user confidence and an active ecosystem.

- Attracting investors and developers: Protocols with high TVL are better positioned to attract venture capital, partnership opportunities, and developer engagement, fueling a virtuous cycle of growth.

TVL Applications Across Protocol Types

- Lending Protocols: For example, Aave and Compound, use TVL to represent the total value of deposited crypto assets.

- Decentralized Exchanges (DEXs): Such as Uniswap and SushiSwap, where TVL reflects the scale of liquidity pools, directly impacting trading slippage and fee revenue.

- Yield Farming and Staking Protocols: Protocols use TVL to determine the total locked value and reward distribution ratios.

- Synthetic Asset Protocols: For example, Synthetix, where TVL measures the total collateral supporting the synthetic asset ecosystem.

Limitations and Considerations of the TVL Metric

While TVL is a fundamental metric, it has notable limitations:

- Double counting: Protocols that utilize wrapped tokens or cross-chain assets may cause TVL to be counted more than once.

- Short-term incentive distortion: Elevated TVL does not always indicate lasting capital lock-up; it can be temporarily boosted by incentive programs.

- Market price fluctuations: Because TVL depends on market value, asset price volatility directly affects this metric.

Therefore, when considering TVL, investors should evaluate it alongside protocol security, user adoption, and long-term growth prospects. This approach provides a more comprehensive assessment.

Summary and Future Outlook

As a core DeFi metric, TVL (Total Value Locked) offers a clear view of protocol liquidity and market trust. As the DeFi ecosystem matures, TVL will remain a crucial benchmark for assessing protocol size, attracting investment, and driving ecosystem development. Looking ahead, greater on-chain data transparency and ongoing protocol innovation is likely to standardize how TVL is calculated and applied. This will provide more reliable decision-making tools for both investors and developers.

Related Articles

The New Era of the NFT Market: From Explosive Peaks to Rational Transformation

The Next 100x Coin? Low-Cap Crypto Gem Analysis

MathWallet Quick Start Guide

Zora NFT Market Update: ZORA Token Airdrop, Layer-2 Expansion, and Creator Incentive Mechanisms

Ethereum Whales Revealed: Who Are the True ETH Giants in 2025?