Will Sidra Break $1,000? In-Depth Price Prediction for Sidra in 2025–2026

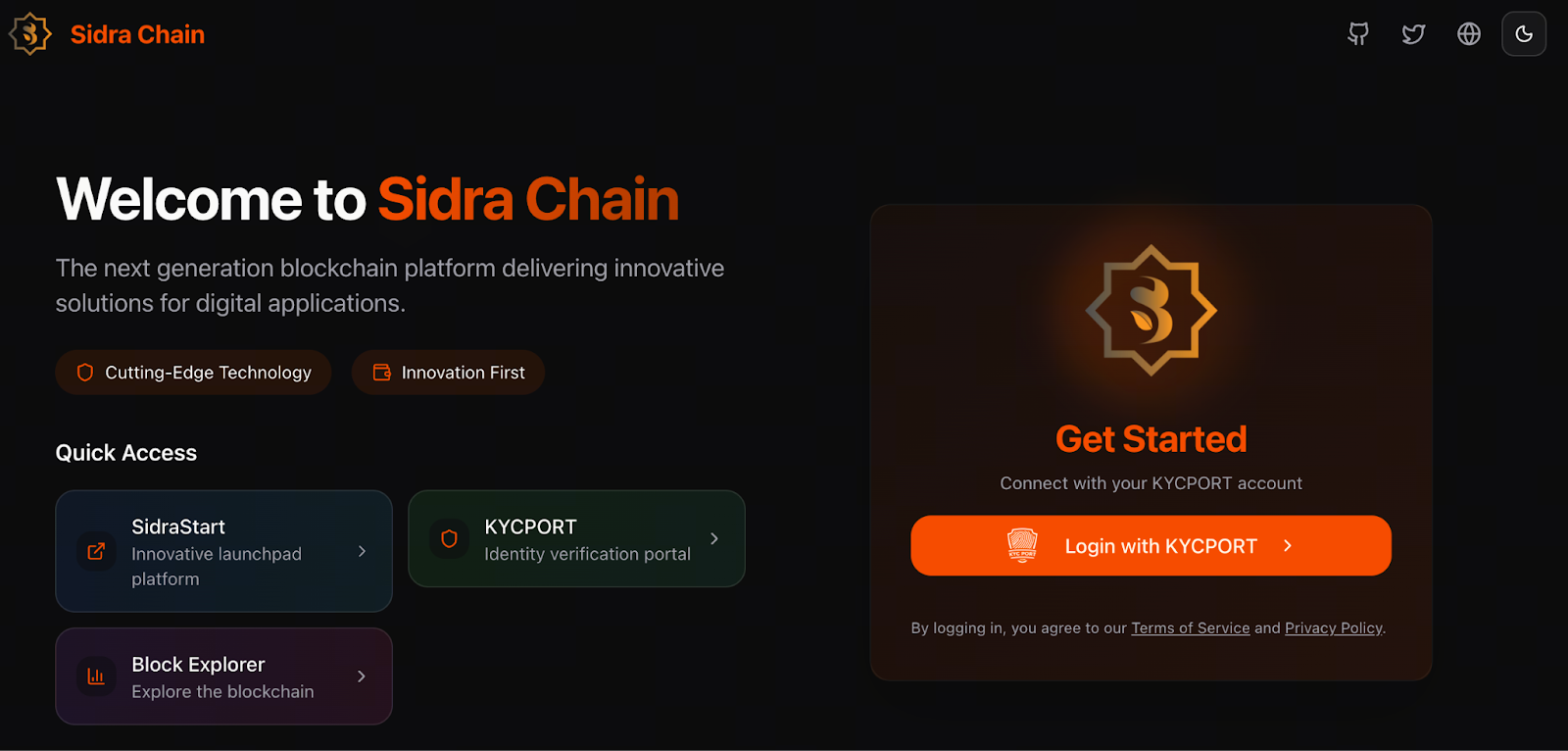

What Is Sidra / Sidra Chain

Sidra (known as Sidra or SDA) is a cryptocurrency project designed to be Shariah-compliant, aiming to offer transparent, fair, and compliant DeFi solutions for Muslim users worldwide. The project’s core principles are to eliminate interest (riba), avoid excessive uncertainty and risk (gharar), and prohibit non-halal investments, integrating faith and financial technology.

By 2025, with the mainnet launch and the introduction of compliance certification mechanisms, Sidra Chain will continue to enhance its infrastructure. Its ecosystem will expand to include DeFi, decentralized exchanges (DEX), and global KYC/KYB collaborations.

Current Price and Market Performance

Sidra briefly reached $525 after listing on certain exchanges. However, Sidra tokens currently have low market liquidity, so many reported “high prices” are the result of minimal trading volume and low-liquidity pools. These prices do not reflect true market value. In short, the current price is subject to an “illusion of liquidity”—it may look high, but buyers and sellers may not be able to transact at those levels.

Three Key Drivers of Price Movement

1. Ecosystem Growth and Infrastructure Upgrades

Sidra Chain has recently upgraded its protocol, reducing block validation times and lowering transaction fees. These improvements make the blockchain more attractive as infrastructure. Increasing numbers of developers are launching DeFi, NFT, cross-chain, and other projects on Sidra Chain. This growing ecosystem activity is a vital factor supporting the token’s long-term value.

2. Compliance and Faith Attributes—Addressing Market Needs

Sidra’s focus on Islamic finance compliance and decentralized finance positions it to attract a global Muslim user base.

If its compliance mechanisms, transparency, and certification prove reliable, Sidra’s blend of “ethics, faith, and technology” could become a unique competitive advantage.

3. Market Expectations and Future Listings/Liquidity Improvements

Market analysts suggest that support from major exchanges, expanded liquidity pools, and growth in users and trading volume could drive Sidra to higher price levels. If the ecosystem continues to expand and real-world use cases are implemented, true demand for the token may far exceed current valuations.

Primary Risks

• Extremely Low Liquidity, Price Cannot Be Realized

Many “high” or “record” prices are calculated in pools with very low liquidity, making actual trades nearly impossible.

• Project Transparency and Compliance Implementation Are Incomplete

Although Sidra emphasizes Shariah compliance, its whitepaper, audit reports, and team information remain uncertain. If regulatory or faith-based standards differ by region, the value proposition based on compliance and faith may not materialize.

• Uncertain User Base and Ecosystem Engagement

While the ecosystem has made progress, it is still far from large-scale adoption. If user and developer growth falls short of expectations, demand for the token may remain weak.

Sidra Price Prediction: Reasonable Range

Based on the analysis above, three price scenarios are projected:

- Conservative scenario (slow liquidity improvement, limited ecosystem growth): The token price may stabilize between $300 and $600, reflecting a correction and stabilization from current levels.

- Neutral scenario (gradual ecosystem development, partial user and developer participation, improved liquidity): In the next 12 to 24 months, the price could return to the $600–$900 range.

- Optimistic scenario (comprehensive ecosystem and compliance implementation, major exchange support, expanded user base): If demand surges and liquidity is sufficient, the price could break above $1,000.

Note that the “optimistic scenario” assumes all conditions are met—compliance, ecosystem growth, liquidity improvement, and market acceptance. Otherwise, “record prices” are unlikely.

Conclusion

Sidra is a crypto project with a unique positioning, combining Islamic finance compliance and blockchain technology. It may become a preferred option for global Muslim and ethical finance investors. However, liquidity, ecosystem scale, compliance, and transparency are still the major uncertainties. If the project team delivers on its roadmap, it could drive Sidra to $1,000. Otherwise, it may remain a highly volatile, speculative token with liquidity risks.

Investors should remain cautious and closely monitor on-chain data, trading volumes, ecosystem engagement, and compliance progress, rather than focusing only on “high price figures.”

Related Articles

The New Era of the NFT Market: From Explosive Peaks to Rational Transformation

The Next 100x Coin? Low-Cap Crypto Gem Analysis

MathWallet Quick Start Guide

Zora NFT Market Update: ZORA Token Airdrop, Layer-2 Expansion, and Creator Incentive Mechanisms

Ethereum Whales Revealed: Who Are the True ETH Giants in 2025?