Exploring DAG-based Blockchain Innovations

Directed Acyclic Graph Explained

Directed Acyclic Graph (DAG) is an emerging technology in the cryptocurrency space that offers an alternative to traditional blockchain technology. This article explores the concept of DAG, its workings, and how it compares to blockchain technology.

DAG vs blockchain technology

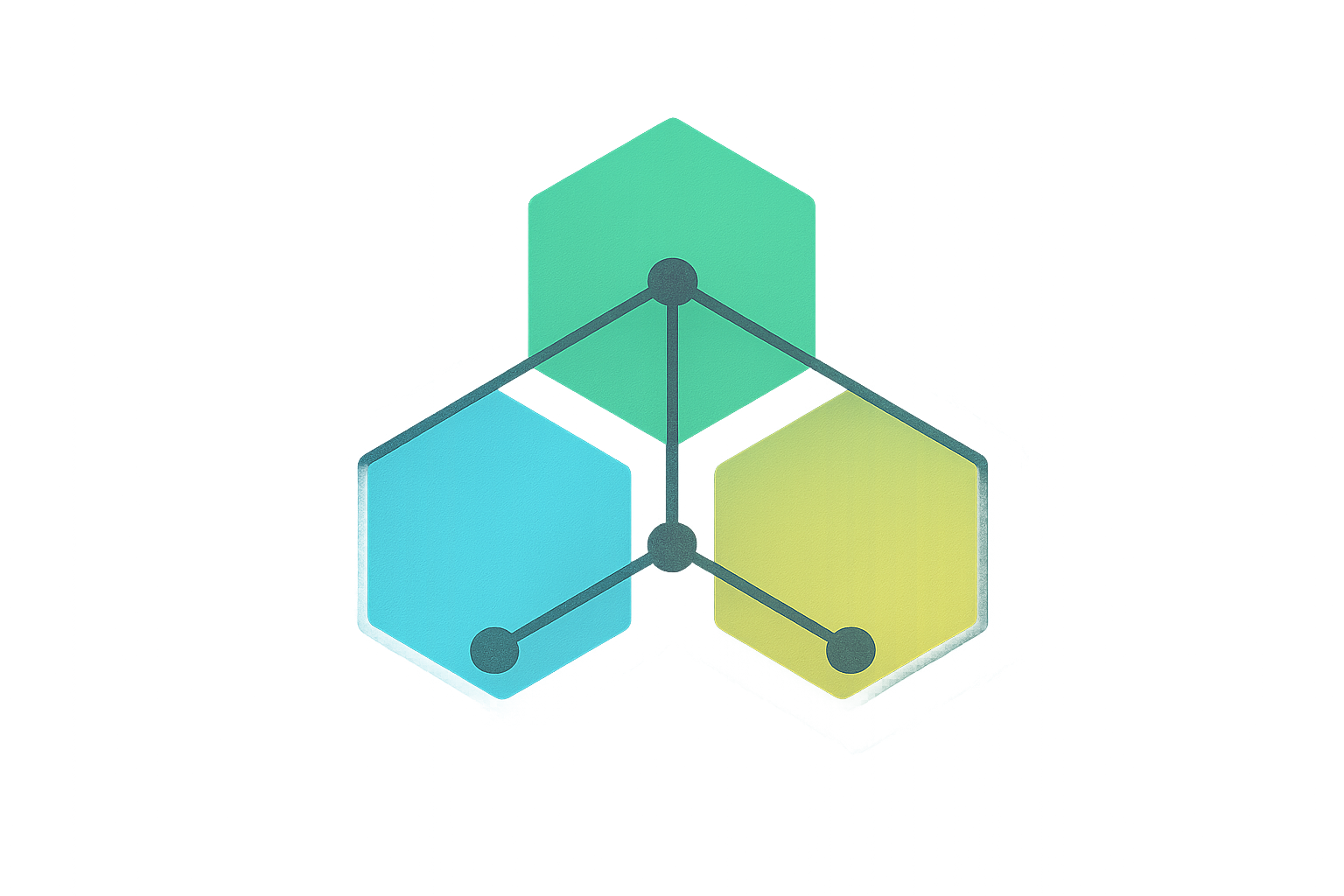

Directed Acyclic Graph (DAG) is a data modeling tool used by some cryptocurrencies as an alternative to blockchain. While blockchain technology relies on a chain of blocks, DAG uses a structure of circles (vertices) and lines (edges) to represent and process transactions. This unique architecture allows for faster transaction speeds and improved scalability.

What's the difference between a DAG and a blockchain?

The main differences between DAG and blockchain lie in their structure and transaction processing. Unlike blockchain, DAG doesn't create blocks. Instead, it builds transactions on top of previous ones. Visually, blockchains appear as a chain of blocks, while DAGs resemble graphs with interconnected nodes.

How does DAG technology work?

In a DAG-based system, each transaction (represented by a circle or vertex) must confirm a previous transaction before being added to the network. This creates a system where transactions are continually built upon each other, forming layers of confirmed transactions. This method ensures fast processing and prevents double-spending by validating the entire transaction path.

What is DAG used for?

DAG technology is primarily used for efficient transaction processing. Its structure allows for faster transactions without the waiting times associated with block creation in blockchain. DAGs are also energy-efficient and particularly useful for micropayments due to their low or non-existent transaction fees.

Which cryptocurrencies use DAG?

Several cryptocurrencies have adopted DAG technology. Notable examples include:

- IOTA (MIOTA): Known for its fast transaction speeds, scalability, and security.

- Nano: Combines DAG and blockchain technology, offering quick transactions with zero fees.

- BlockDAG: Utilizes DAG for energy-efficient mining.

DAG pros and cons

DAG technology offers several advantages, including:

- Faster transaction speeds

- Zero or low fees

- Energy efficiency

- Improved scalability

However, it also faces some challenges:

- Potential centralization issues

- Limited testing at scale

The final word

Directed Acyclic Graph technology presents an intriguing alternative to blockchain, offering potential solutions to some of blockchain's limitations. While DAG shows promise in terms of transaction speed, scalability, and energy efficiency, it is still a developing technology with unexplored possibilities and limitations. As the cryptocurrency space continues to evolve, the role and impact of DAG technology will likely become clearer, potentially shaping the future of digital transactions and decentralized systems.

FAQ

What does the DAG stand for?

DAG stands for Directed Acyclic Graph, a key concept in computer science used for data processing and blockchain technology.

What is a DAG slang?

DAG slang refers to 'Directed Acyclic Graph', a data structure used in some cryptocurrencies as an alternative to blockchain for faster transactions and scalability.

What is DAG?

DAG (Directed Acyclic Graph) is a data structure used in blockchain technology to improve scalability and transaction speed. It allows for parallel processing of transactions, unlike traditional blockchain's linear approach.

What does DAG mean in America?

In America, DAG is an acronym for Directed Acyclic Graph, a data structure used in blockchain technology for faster transactions and scalability.

Exploring the Three Layers of Avalanche Blockchain Architecture

Understanding Directed Acyclic Graphs in Blockchain Systems

How Does Basic Attention Token's On-Chain Data Reflect Brave Browser's Growth in 2025?

How to Analyze a Crypto Project's Fundamentals: 5 Key Factors to Consider

Top IDO Launchpads for Crypto Projects in 2023

How Does CMC20 Compare to Theta Network in the DeFi Landscape?

What is Ripple USD (RLUSD)? A USD-Backed Stablecoin for International Remittances and DeFi

What Is DeFi? An In-Depth Guide to Decentralized Finance

PayFi Unlocked: Crypto Payment Use Cases in Recent Years

What is For Traders Only (FTO)? A Solana memecoin that surged 25,000% in just 4 days

Leading Web3 Wallet Reaches 30M Users, Surpasses Mainstream Competitor in Recent App Downloads